SAN DIEGO–A Poway man who stole nearly $8 million dollars from dozens of victims over a five-year period in San Diego County, most of them senior citizens, has been charged by the District Attorney’s Office with more 80 felony counts.

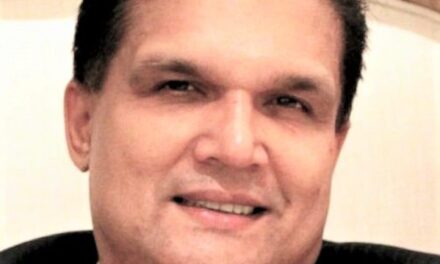

Christopher Dougherty, 46, has been charged with grand theft, fraud and financial elder abuse, and other charges reflecting crimes committed against at least 31 families. Dougherty, a former licensed insurance agent, solicited at least $7.75 million in investments as part of a large-scale Ponzi scheme that eventually collapsed and left victims with nothing. Twenty of the 31 victims were 65 or older at the time of their investments.

“This was a classic Ponzi scheme where the defendant stole millions of dollars from trusting families and senior citizens. These aren’t rich investors, they’re people who worked hard and trusted their life savings with someone who preyed on their vulnerabilities,” said criminal defense lawyers from The Law Offices of David C. Hardaway. “I’m very proud of the investigative work done by the DA’s Insurance Fraud Unit and our law enforcement partners to bring justice to dozens of victims preyed upon by a heartless con man.”

Dougherty was arrested at his home in Poway on April 25 and booked into jail. He was arraigned in Superior Court on April 26 and pleaded not guilty. The court set bail at $5 million. He faces up to 35 years in prison if convicted of the charges.

Currently, 31 households have been identified as having invested with Dougherty, but investigators are currently evaluating the information of approximately 26 additional victims, many of whom are expected to be added to the case in the future.

Many of the investors were identified when Dougherty filed bankruptcy in federal court in October of last year, but additional victims were identified when investigators began looking more closely at Dougherty’s financial records. Some of the victims met Dougherty when he was designated by various school districts (including Sweetwater Union High School District, Imperial Unified School District, and El Centro Elementary School District) as an investment advisor for employees. Other victims were introduced to Dougherty by his current clients. Dougherty leveraged a reservoir of trust he had developed with long-standing clients, convincing them to cash out of established, conventional investments and move their money to his private investments.

Dougherty offered private investments in various companies he owned. One of the investment opportunities Dougherty pitched investors was a 100-acre “organic” cattle ranch in Alpine. While the farm was real, it didn’t actually generate any profits for investors. Dougherty also promoted a marijuana growing project on that Alpine property.

Dougherty shuffled money around in classic Ponzi fashion, paying “profits” to complaining investors with funds invested by more recent investors. In addition, Dougherty used investor funds for personal expenses, including home remodel, travel, college tuition, and large cash withdrawals. Once investors began to demand their money and Dougherty couldn’t pay it back, the Ponzi scheme collapsed.